All Categories

Featured

Table of Contents

The are whole life insurance and global life insurance. expands cash worth at an assured interest rate and also via non-guaranteed rewards. grows cash money worth at a dealt with or variable price, depending upon the insurance provider and plan terms. The cash money value is not included to the survivor benefit. Cash value is a function you benefit from while alive.

The plan car loan interest price is 6%. Going this path, the rate of interest he pays goes back right into his plan's money worth instead of a financial institution.

Imagine never ever having to fret regarding bank financings or high rate of interest prices once more. That's the power of boundless banking life insurance policy.

There's no set lending term, and you have the liberty to select the repayment timetable, which can be as leisurely as paying off the financing at the time of death. This flexibility includes the servicing of the loans, where you can decide for interest-only payments, maintaining the car loan balance flat and convenient.

Holding cash in an IUL repaired account being attributed rate of interest can typically be better than holding the cash money on deposit at a bank.: You have actually constantly desired for opening your own pastry shop. You can obtain from your IUL plan to cover the initial expenditures of leasing an area, buying tools, and employing personnel.

Infinite Banking Success Stories

Individual fundings can be acquired from typical banks and lending institution. Right here are some bottom lines to consider. Charge card can supply an adaptable way to obtain cash for really temporary periods. Nevertheless, borrowing money on a bank card is usually really costly with yearly portion rates of passion (APR) frequently reaching 20% to 30% or even more a year.

The tax treatment of policy car loans can differ considerably relying on your country of house and the certain terms of your IUL policy. In some regions, such as North America, the United Arab Emirates, and Saudi Arabia, policy loans are normally tax-free, offering a substantial advantage. In various other territories, there might be tax ramifications to consider, such as potential taxes on the funding.

Term life insurance coverage only offers a death advantage, without any kind of cash money value buildup. This implies there's no cash value to borrow versus.

Infinite Banking Example

When you first become aware of the Infinite Financial Idea (IBC), your first reaction could be: This appears also good to be real. Maybe you're cynical and believe Infinite Banking is a fraud or plan - how to become your own bank. We want to set the document straight! The trouble with the Infinite Financial Idea is not the idea yet those individuals providing an adverse review of Infinite Banking as a principle.

As IBC Authorized Practitioners via the Nelson Nash Institute, we thought we would certainly answer some of the top inquiries individuals search for online when discovering and comprehending everything to do with the Infinite Banking Idea. So, what is Infinite Financial? Infinite Financial was developed by Nelson Nash in 2000 and completely discussed with the magazine of his publication Becoming Your Own Banker: Open the Infinite Banking Idea.

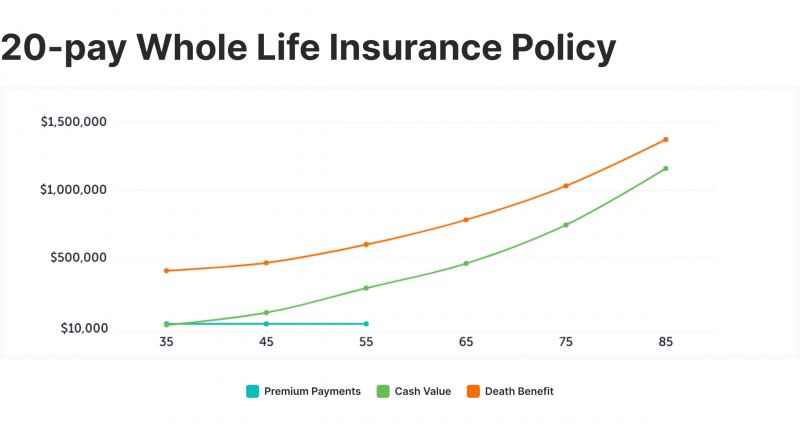

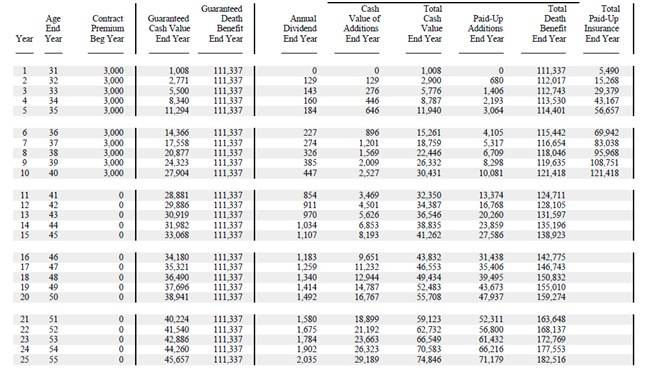

Whole Life Insurance Cash Flow

You believe you are coming out economically in advance due to the fact that you pay no passion, however you are not. With saving and paying money, you might not pay passion, yet you are utilizing your money as soon as; when you spend it, it's gone permanently, and you offer up on the possibility to earn lifetime substance rate of interest on that cash.

Even banks utilize whole life insurance policy for the very same objectives. The Canada Earnings Company (CRA) even recognizes the value of getting involved whole life insurance coverage as an unique asset course made use of to produce long-term equity safely and naturally and provide tax obligation benefits outside the scope of typical investments.

Bank Infinity

It allows you to generate wealth by meeting the banking feature in your very own life and the capability to self-finance major way of life purchases and costs without interrupting the compound passion. One of the simplest methods to consider an IBC-type participating entire life insurance policy policy is it approaches paying a home mortgage on a home.

When you borrow from your taking part whole life insurance plan, the money worth continues to expand continuous as if you never borrowed from it in the very first area. This is because you are making use of the money worth and death advantage as security for a lending from the life insurance company or as collateral from a third-party loan provider (known as collateral loaning).

That's why it's necessary to function with a Licensed Life insurance policy Broker accredited in Infinite Banking who structures your getting involved whole life insurance policy policy properly so you can prevent unfavorable tax ramifications. Infinite Financial as an economic method is except everybody. Here are some of the benefits and drawbacks of Infinite Financial you must seriously think about in deciding whether to move forward.

Our recommended insurance service provider, Equitable Life of Canada, a common life insurance policy company, specializes in participating entire life insurance policies specific to Infinite Financial. Additionally, in a mutual life insurance policy firm, insurance policy holders are taken into consideration firm co-owners and get a share of the divisible excess generated yearly through rewards. We have a selection of carriers to pick from, such as Canada Life, Manulife and Sunlight Lifedepending on the needs of our customers.

Please likewise download our 5 Top Inquiries to Ask A Limitless Financial Agent Prior To You Employ Them. For additional information regarding Infinite Banking see: Please note: The material given in this newsletter is for informative and/or academic objectives only. The information, viewpoints and/or sights revealed in this e-newsletter are those of the writers and not necessarily those of the supplier.

Whole Life Insurance Bank On Yourself

Nash was a financing professional and follower of the Austrian institution of business economics, which promotes that the value of goods aren't clearly the result of standard economic frameworks like supply and demand. Instead, people value money and goods differently based on their financial standing and needs.

One of the challenges of conventional banking, according to Nash, was high-interest prices on loans. Also many individuals, himself included, obtained into economic trouble due to reliance on banking establishments.

Infinite Banking requires you to own your economic future. For ambitious individuals, it can be the very best economic tool ever before. Below are the benefits of Infinite Banking: Arguably the single most advantageous aspect of Infinite Financial is that it improves your cash money flow. You don't require to experience the hoops of a standard financial institution to get a loan; simply request a plan financing from your life insurance coverage company and funds will be provided to you.

Dividend-paying whole life insurance coverage is very reduced danger and supplies you, the insurance policy holder, a lot of control. The control that Infinite Financial provides can best be organized into two classifications: tax benefits and possession defenses. Among the factors whole life insurance policy is optimal for Infinite Banking is just how it's tired.

Entire life insurance policy plans are non-correlated assets. This is why they function so well as the monetary foundation of Infinite Financial. Regardless of what occurs in the market (stock, genuine estate, or otherwise), your insurance coverage plan keeps its well worth.

Entire life insurance policy is that 3rd bucket. Not only is the price of return on your whole life insurance coverage policy guaranteed, your death benefit and costs are likewise guaranteed.

Infinite Wealth And Income Strategy

This structure straightens completely with the principles of the Perpetual Wealth Approach. Infinite Financial interest those seeking better financial control. Below are its main advantages: Liquidity and accessibility: Policy finances give prompt access to funds without the limitations of standard small business loan. Tax effectiveness: The cash money value grows tax-deferred, and plan financings are tax-free, making it a tax-efficient tool for constructing wide range.

Property protection: In numerous states, the cash worth of life insurance coverage is secured from lenders, including an additional layer of monetary safety. While Infinite Banking has its benefits, it isn't a one-size-fits-all service, and it features substantial drawbacks. Here's why it might not be the best technique: Infinite Banking usually calls for elaborate plan structuring, which can puzzle insurance policy holders.

Latest Posts

Bank On Yourself Program

Can Defi Allow You To Be Your Own Bank? - Unchained Crypto

Banking With Life